- Home

- Articles

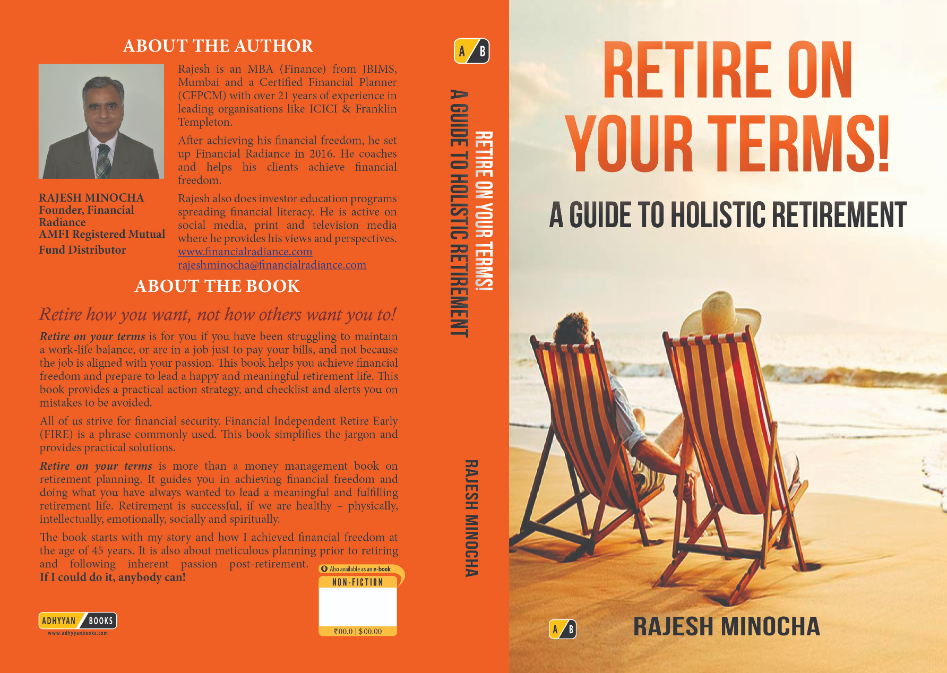

- Retire on your terms: A Guide to Holistic Retirement

Retire on your terms: A Guide to Holistic Retirement

Retire on your terms: A Guide to Holistic Retirement

Retire how you want, not how others want you to!

Have you been struggling to maintain a work-life balance?

Are you working just to pay your bills?

Is your job aligned with your passion?

Are you striving for financial freedom?

Retirement can be an exciting time, but it can also be overwhelming if you’re not financially prepared. Planning for retirement takes time and effort, but with the right steps, you can make it a lot easier. In this blog post, we will go through some simple steps that can help you achieve financial freedom and retire with confidence.

1. Determine your retirement goals

To secure a comfortable retirement, it is essential to determine your retirement goals. Start by asking yourself what kind of lifestyle you want to lead during retirement. Do you want to travel the world, enjoy leisure activities, or simply spend time with family and friends? Once you have a clear picture of your ideal retirement, you can calculate the amount of money you need to save to achieve those goals. It is essential to consider factors such as inflation, healthcare costs, and unexpected expenses.

One way to determine your retirement goals is to seek the advice of a financial advisor. They can help you create a customized retirement plan that aligns with your goals and financial situation.

It is also essential to revisit your retirement goals regularly and make adjustments as needed. By determining your retirement goals and creating a solid plan, you can enjoy a stress-free retirement.

2. Calculate your retirement income

Calculating your retirement income is a crucial step towards financial planning for your post-retirement life. It helps you estimate how much money you will have available to meet your expenses and maintain your lifestyle after you stop working. To calculate your retirement income, start by determining your sources of income, including your retirals like employee provident fund, public provident fund, national pension scheme, social security benefits, pension plans, and savings. You should also consider the impact of inflation and taxes on your retirement income. If you want to maintain your current lifestyle, you should aim to replace at least 70% to 80% of your pre-retirement income. Though this is only a guideline and your expenses in retirement could vary depending on what you want to do in retirement. To achieve this, you may need to adjust your savings and investment strategies. It is also important to factor in unexpected expenses, such as healthcare costs or emergencies. By carefully calculating your retirement income, you can plan for a financially secure retirement and enjoy your golden years with peace of mind.

3. Create a retirement savings plan

Creating a retirement savings plan is crucial for ensuring financial security in the golden years. To begin, it is important to assess current financial standing and determine a realistic retirement goal. Next, one should consider the various investment options available. It may be helpful to seek guidance from a personal finance professional to determine which investments align with individual goals and risk tolerance. Consistent contributions to the retirement savings plan are essential to reaching the desired retirement goal. To ensure consistency, consider setting up automatic contributions or increasing contributions as income increases.

Additionally, it is important to regularly review and adjust the savings plan as financial situations change. By taking these steps and creating a solid retirement savings plan, individuals can better prepare for a comfortable and secure retirement.

4. Invest wisely

Investing is a great way to secure your financial future, but it is important to do it wisely. Before investing, it is crucial to do your research and understand the risks involved. You should also set realistic goals and have a clear understanding of your investment timeline. It is important to diversify your portfolio and not put all your eggs in one basket. This means investing in different asset classes such as stocks, bonds, and real estate. Another important factor to consider is the fees associated with investing. High fees can significantly eat into your returns over time, so choosing investments with low fees is important. Lastly, it is important to regularly review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance. By following these guidelines, you can invest wisely and achieve your financial goals.

5. Monitor and adjust your plan

To ensure the success of your plan, it is crucial to monitor and adjust it as needed. Monitoring allows you to track progress and identify any areas that require attention. Keeping an eye on your plan also helps you to determine whether you are on track to meet your goals or if adjustments are necessary. Regularly reviewing your plan enables you to make informed decisions and take corrective action when needed. Adjustments may include revising timelines or reallocating resources. It’s important to remember that your plan should be flexible and adaptable so that you can respond to changing circumstances. It is also important to communicate any changes to all stakeholders and team members. By monitoring and adjusting your plan, you can ensure you stay on track and achieve the desired outcomes.

6. Retirement Planning Checklist

Retirement planning is one of the most important things to consider when it comes to securing your future. To help you get started, we have put together a retirement planning checklist with some key things to consider. You need to consider financial readiness as well as the non-financial aspects of retirement like deciding when to retire, where to retire, and what to do during retirement.

There is also a need for a mentor who has gone through the retirement process and can help you in adjusting towards a retired life especially if you are considering early retirement. Financial Independence Retire Early (FIRE) has been gaining a lot of importance. Many people want to retire early for various reasons like burnout in professional life, not enjoying what they do, medical reasons, taking care of family members especially the elderly and a lot more.

7. Retirement Mistakes

Retirement is a significant milestone in life, but it requires careful planning to ensure a comfortable and secure future. Unfortunately, many people make common mistakes that can jeopardize their retirement plans. One of the biggest mistakes is failing to save enough money early on. It is important to start saving for retirement as soon as possible to take advantage of compound interest. Another mistake is underestimating the cost of living in retirement. Many retirees assume their expenses will decrease, but the reality is that healthcare, travel, and leisure activities can add up quickly. It is also important to avoid cashing out retirement accounts early, as this can lead to penalties and taxes. Lastly, neglecting to create a comprehensive retirement plan can be detrimental. It’s crucial to seek professional advice and create a plan that includes sources of income, expenses, and contingencies. Avoid these common mistakes, and you’ll be on your way to a successful retirement.

Conclusion

Retiring doesn’t have to be a daunting task. By following these simple steps, you can take control of your finances and achieve financial freedom. Remember, the earlier you start planning and saving, the better off you will be in retirement.

I will make it easier for you. I have launched a Book on this topic on 24 June 2023.

Retire on your terms is more than a money management book on retirement planning. It guides you in achieving financial freedom and doing what you have always wanted to lead a meaningful and fulfilling retirement life. Retirement is successful, if we are healthy – physically, intellectually, emotionally, socially and spiritually.

The book starts with my story and how I achieved financial freedom at the age of 45 years. It is also about meticulous planning prior to retiring and following inherent passion post-retirement. If I could do it, anybody can!

The Book, Retire on your terms, was launched on 24th June 2023 by my father, on the occasion of his Birthday. (Launch link: https://youtu.be/95Fryq_-0XQ).

The Book is live on Amazon India and is already a best seller. It had an all-time high rank of 1357, so far amongst all Books on Amazon. The paperback can be purchased for Rs 299 for a limited-period discount, (MRP: Rs 399) while the ebook can be purchased for Rs 99. If you have Kindle unlimited subscription, then the book can also be read for free. You can purchase the Book on Amazon India. It is also available on Flipkart and other websites. The Book is also available on Amazon Globally. Here is the link for Amazon U.S. For other countries, just search for “Retire on your terms”, on Amazon website. Please do not forget to leave a review on the Website after you have read the book. It will help others in making a decision if they would like to purchase the book.